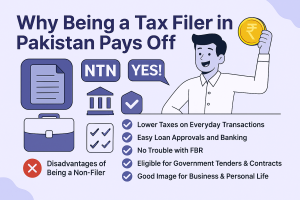

WHY BEING A TAX FILER IN PAKISTAN PAYS OFF?

If you’re wondering whether getting your NTN (National Tax Number) or becoming a tax filer in Pakistan is really worth it — the answer is a big YES!

In this blog, we break down how being a tax filer helps you save money, build financial credibility, and unlock real benefits — whether you’re an individual or running a business.

What Is an NTN (National Tax Number)?

An NTN is your tax identity issued by the Federal Board of Revenue (FBR). If you want to legally do business, file income tax returns, buy or sell property, or open a business bank account in Pakistan, you need an NTN.

Common uses of NTN:

-

Business registration and tax filing

-

Import/export and government contracts

-

Buying or selling real estate

-

Vehicle registration and investments

🔹 Who Is a Filer?

A filer is someone whose name appears on the FBR’s Active Taxpayers List (ATL) by submitting their income tax returns on time. A non-filer, on the other hand, is someone who hasn’t filed taxes — and they pay more for almost everything!

🔥 Top Benefits of Being a Filer in Pakistan

✅ 1. Lower Taxes on Everyday Transactions

Filing your tax returns helps you pay less tax on:

-

Bank withdrawals

-

Property sales/purchases

-

Vehicle registration and transfers

-

Dividends and profits

Example: A filer pays 1% tax on property, while a non-filer pays 2%.

✅ 2. Easy Loan Approvals and Banking

Banks and financial institutions trust filers more. So whether it’s a business loan, home financing, or vehicle leasing, your chances of approval are much higher.

✅ 3. No Trouble with FBR

Tax filers stay safe from audits, fines, and notices from the FBR. Filing your returns yearly shows that you’re compliant and honest.

✅ 4. Eligible for Government Tenders & Contracts

Only filers can bid for most government projects, supply tenders, or even register certain types of businesses.

✅ 5. Good Image for Business & Personal Life

Being a filer improves your credibility, whether you’re an entrepreneur, freelancer, or salaried person. People prefer doing business with registered and tax-compliant individuals.

❌ Disadvantages of Being a Non-Filer

-

Higher withholding taxes

-

Limited banking and investment options

-

No access to government projects

-

Risk of penalties and FBR notices

-

Bad image in financial institutions

💼 How Adl Law Associates Can Help You

At Adl Law Associates Lahore, we provide end-to-end support for:

-

NTN Registration

-

Income Tax Filing for Salaried, Business & AOPs

-

Business & Company Registration

-

Sales Tax Return Filing

-

FBR Compliance and Legal Tax Advice

With our help, becoming a tax filer is easy, fast, and stress-free.

Getting your NTN and becoming a tax filer in Pakistan is more than just a legal formality — it’s a smart financial move that brings huge benefits.

Let us help you stay ahead of tax worries and build a stronger financial future.

Start Your Business in Pakistan the Right Way

Are you planning to start a business in Pakistan but confused about where to begin? You’re not alone!

Whether you’re a freelancer, shopkeeper, ecommerce seller, service provider, or startup founder, the first step to running a legal and successful business is proper business registration.

At Adl Law Associates Lahore, we specialize in making business registration, NTN issuance, and FBR compliance simple, fast, and affordable for everyone.

💡 Why Should You Register Your Business?

Registering your business means you’re legal, recognized, and protected. Here’s why it’s important:

✅ Gain Trust — Your clients and partners trust registered businesses more

✅ Open a Business Bank Account — Needed for transactions, payments & growth

✅ Get Your NTN from FBR — Compulsory for income tax filing and government dealings

✅ Apply for Loans & Funding — Banks and investors prefer legal businesses

✅ Sell Online — Platforms like Daraz, Amazon, and Alibaba require business registration

✅ Avoid Legal Trouble — Stay protected from penalties and FBR notices

✅ Access Government Tenders & Contracts

🧾 Who Should Register a Business?

This guide is for you if you are:

-

📱 A freelancer offering services online

-

🛍️ Running a shop, boutique, or home-based business

-

🚚 Doing import/export or wholesale

-

🖥️ Managing an ecommerce store or selling on Amazon/Daraz

-

👨⚖️ Starting a private limited company or partnership firm

-

🧾 Wanting to file income tax returns and become a tax filer

🧭 Types of Business Registration in Pakistan

1. Sole Proprietorship

-

Simple and affordable

-

Ideal for small businesses and freelancers

-

Registered with FBR for NTN and tax filing

2. Partnership Firm (AOP)

-

For 2 or more partners

-

Registered with Registrar of Firms

-

Requires a Partnership Deed

3. Private Limited Company

-

Registered with SECP (Securities & Exchange Commission of Pakistan)

-

Best for startups, tech companies, and growing businesses

-

Offers limited liability and professional brand image

🔧 How to Register a Business in Pakistan — Step-by-Step

Here’s a quick and easy guide to follow:

✅ Step 1: Decide the Business Type

Don’t worry — if you’re unsure, we’ll guide you on what suits your needs.

✅ Step 2: Choose a Business Name

Make it unique and related to your services.

✅ Step 3: Register for NTN

We help you apply for your National Tax Number (NTN) with FBR in just a few days.

✅ Step 4: Prepare Legal Documents

We take care of:

-

CNIC

-

Address proof

-

Partnership deed (for AOP)

-

SECP documents (for Pvt Ltd)

-

Any supporting forms

✅ Step 5: Submit to FBR/SECP/Registrar

Leave the technical side to us. We submit your application and track the approval.

✅ Step 6: Open a Business Bank Account

Once you’re registered, you can open a business bank account easily — we help you with this too.

💼 Why Choose Adl Law Associates Lahore?

With years of experience in taxation, legal advice, and business setup, we help:

-

Register sole proprietorships, AOPs, and companies (Pvt Ltd)

-

File income tax and sales tax returns

-

Register NTN and Sales Tax Number with FBR

-

Handle corporate legal matters professionally

-

Offer free consultation & documentation support

We understand the pain of paperwork and delays — that’s why our services are fast, reliable, and affordable.

📌 Real FAQs from Our Clients

Q: How much time does business registration take in Pakistan?

A: Usually 1 working day for Sole Proprietorship and AOP. Pvt Ltd may take 7–10 days.

Q: Can I register my online business in Pakistan?

A: Yes! Whether you sell on Instagram, Daraz, or Amazon, we can register your business and get your NTN.

Q: Is business registration required for opening a bank account?

A: Yes. Most banks now require an NTN or business proof to open a current account.

Q: Do I need a lawyer to register a business?

A: Yes, having a legal expert like Adl Law Associates ensures that all your documents are accurate and FBR-compliant.

🚀 Final Thoughts: Your Business, Your Future

Starting a business is one of the best decisions you can make — but only if you do it legally and the right way.

Don’t risk penalties, lost clients, or tax problems. Let Adl Law Associates handle your business registration, NTN, and tax filing — so you can focus on growing your dream business.

📞 Contact us today for a free consultation and expert help with:

-

Business Registration

-

NTN Registration

-

Tax Filing for Freelancers & Companies

-

Legal Business Advisory

Why Filing Your Income Tax Return in Pakistan Matters— A Must-Know Guide for 2025

In Pakistan, filing your income tax return isn’t just for the rich or for businesses anymore. Whether you’re a salaried employee, freelancer, shopkeeper, online seller, or small business owner, if you’re earning money, the law says you must file your tax return with the FBR.

Still confused? Worried about FBR notices? Wondering what the benefit is if you’re already paying tax?

This blog is your complete, friendly guide on why you should file your income tax return and how AdL Law Associates can make it easy for you.

📌 What Is an Income Tax Return (ITR)?

An Income Tax Return (ITR) is an annual statement you submit to the Federal Board of Revenue (FBR). It tells the government:

-

How much did you earn

-

How much tax have you already paid (e.g. deducted from salary or bank)

-

What were your expenses?

-

Whether you’re eligible for a refund or need to pay more tax

✅ 10 Strong Reasons to File Your Income Tax Return in Pakistan

1. Become a Filer (ATL—Active Taxpayer List)

As a filer, you enjoy many benefits, like:

-

Lower withholding tax on banking, vehicle registration, and property

-

Less deduction on profits/dividends

-

Trust from clients and companies

Non-filers pay up to double the tax!

2. Avoid Heavy FBR Penalties

FBR can issue notices or even impose fines up to Rs. 40,000 for non-filing. Regular filing = safe and secure tax profile.

3. Get Visa Support

Many embassies (USA, Canada, UK, UAE) require your tax returns and wealth statements for visa applications. Filing proves your legal and declared income.

4. Access to Business Deals, Grants & Tenders

If you plan to grow your business or startup, filing taxes is essential for:

-

Government tenders

-

Vendor registration

-

B2B partnerships

-

Investor confidence

5. Tax Refunds & Adjustments

Already paid more tax than needed? Filing lets you claim a refund or adjust your tax liability in future returns.

6. Financial Proof for Loans, Leases, and Credit Cards

Want to buy a house or a car or apply for a business loan? Banks need your FBR tax profile and filed tax returns.

7. Property Purchase or Transfer

As per FBR laws, only filers can register properties above a certain value. Non-filers face high taxes and extra steps.

8. Peace of Mind from FBR Scrutiny

By filing your return annually, you declare your income and records. It reduces the risk of:

-

Surprise FBR audits

-

Notices or inquiries

-

Frozen bank accounts or penalties

9. NTN Activation & Legal Compliance

When you file your return, your NTN (National Tax Number) is active. This is the first step toward legal and smart tax management.

10. It’s Easier Than You Think—Especially With Help!

Don’t fear the process — at Adl Law Associates, we handle your complete return filing online or in-office, without stress.

👥 Who Should File a Tax Return in Pakistan?

You must file a return if:

-

You’re salaried and earn over Rs. 600,000/year

-

You’re a freelancer, consultant, or self-employed

-

You own a shop, business, or trade license

-

Do you have rental income or own property

-

You receive foreign income, remittances or investments

-

You bought a car or property this year

-

You’re an e-commerce seller or Daraz store owner

💡 Even if you’re below the taxable income, filing still makes you a filer and gives you benefits.

📑 Documents Needed for Filing

Here’s what we usually need to file your return:

-

CNIC

-

Salary slip or income statement

-

Bank statement (last 12 months)

-

Utility bills or rent details (for businesspersons)

-

Details of owned properties or vehicles

-

Investments (if any)

-

Tax deduction certificate from banks

🧠 Common Questions Answered

Q: What if I’ve never filed before?

No problem! We handle new NTN registration and help you file even if it’s your first time.

Q: Can freelancers or home-based workers file taxes?

Yes — and they should! FBR now monitors bank accounts and foreign remittances.

Q: How much tax do I need to pay?

It depends on your income type and amount and if you’re a filer. We calculate everything for you.

Q: What if I’m late?

You can still file with a small penalty or file a backdated return if required.

🔐 Your Trusted Tax Filing Partner—ADL Law Associates

We are a legal and tax consultancy firm with 10+ years of experience in:

-

NTN registration

-

Income tax return filing for individuals and businesses

-

Wealth statements and ATL listings

- Tax planning

-

Dealing with FBR notices

-

Filing backdated returns

-

Income & Sales tax, and corporate audit compliance

We handle everything — paperwork, calculations, online portal, and follow-ups.

📣 Take the First Step—File Your Tax Return Today!

Why wait? Save money, stay safe, and gain financial confidence by filing your tax return with Adl Law Associates.

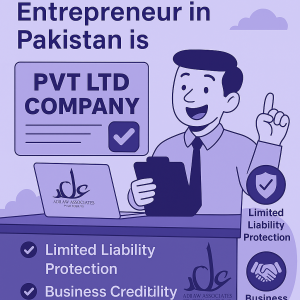

Why Every Smart Entrepreneur in Pakistan is Registering a Pvt Ltd Company

Starting a business in Pakistan? Registering a Private Limited Company (Pvt Ltd) can be the smartest decision for building a professional, legally protected, and scalable enterprise. At Adl Law Associates, we help startups and growing businesses every day to register their companies the right way—quickly and legally.

📄 What is a Private Limited Company in Pakistan?

A Private Limited Company is a business entity that is registered with the Securities and Exchange Commission of Pakistan (SECP) under the Companies Act, 2017. It is a separate legal entity, which means your personal assets are protected and your business can operate under its own name.

There are two types of Pvt Ltd companies:

- Single Member Company (SMC) – One director/owner

- Private Limited Company – Minimum two directors

✅ Benefits of Registering a Private Limited Company

1. Limited Liability Protection

In case of financial losses, your personal assets remain safe. You are only liable for the capital invested in the company.

2. Business Credibility

Clients, banks, and investors prefer working with registered companies. It shows commitment and professionalism.

3. Easy Transfer of Ownership

Shares in a Pvt Ltd company can be sold or transferred easily, which helps when onboarding new partners or investors.

4. Perpetual Succession

The company continues to exist even if the directors change due to death or exit. It has a continuous life.

5. Access to Loans & Government Tenders

Registered companies are eligible to apply for bank financing, government schemes, and business tenders.

6. Brand Name Protection

Once registered with SECP, your company name is legally protected across Pakistan.

❌ Disadvantages You Should Know

While there are many advantages, some points to consider:

- Annual Compliance Costs: Audit, SECP filings, and FBR tax filing are mandatory.

- Legal Formalities: More documentation is involved compared to a sole proprietorship.

- Public Disclosure: Some company information is public on SECP’s portal.

📈 Taxation of Private Limited Companies in Pakistan (2025)

Understanding tax rates is key to planning your business finances. Here are the tax rules applicable to Pvt Ltd companies in 2025:

- Corporate Income Tax: 29% flat rate

- Minimum Turnover Tax: 1.25% (in case of low profit or loss)

- Sales Tax: 18% (if registered under Sales Tax Act)

- Withholding Tax: Applies on salaries, rent, professional services and expenses

Having a professional tax consultant can help you avoid penalties and manage tax benefits effectively.

🚀 Steps to Register a Private Limited Company with SECP

- Choose Company Name (Check availability at SECP online portal)

- Prepare Documents (CNICs, Memorandum & Articles of Association)

- Online Application via SECP e-Services

- Company Registration Certificate Issued

- Apply for NTN with FBR

- Open Company Bank Account

- Register for Sales Tax (if applicable)

📞 Let ADL Law Associates Handle Your Company Registration

We provide end-to-end services, including:

- Company Registration (SMC / Pvt Ltd)

- NTN & Sales Tax Registration

- Trademark Registration

- Legal Agreements

- Income & Sales Tax Filing

With our expert team, you can focus on growing your business while we handle all legal and tax matters professionally.

✨ Why Choose Us?

- Affordable Packages for Startups

- Fast SECP Registration Process

- 100% Legal Compliance

- Trusted by Businesses Across Pakistan

🌟 Ready to Start Your Pvt Ltd Company?

Visit our office in Lahore or contact us today for free consultation. Let ADL Law Associates help you build your future.

🔖 Why Filing Your Tax Return On Time Matters

If you’re living or doing business in Pakistan, it’s time to get serious about your Income Tax Return Filing. At Adl Law Associates, we know how confusing and stressful tax season can be—that’s why we’re here to simplify it for you.

Don’t Miss the Tax Return Deadline in Pakistan—File Early & Save Big!

Missing the FBR tax deadline can cost you more than just money. It can affect your business credibility, bank transactions, visa applications, and even your peace of mind. Here’s what timely filing offers:

✅ Avoid Heavy Penalties

Late filing can lead to fines, audits, and legal notices.

⭐ Become a Filer and Enjoy Benefits

Filers enjoy lower tax rates, reduced withholding taxes, and better access to loans.

🏢 Business Growth & Compliance

Companies that are regular filers are eligible for government tenders, contracts, and financing opportunities.

🌐 Tax Return Filing Deadline for 2025

The last date to file your income tax return in Pakistan is expected to be 30th September 2025 for salaried individuals, businesspersons, and companies (unless extended by FBR).

Don’t wait till the last moment. Filing early means:

- More time to correct errors

- Quick processing of refunds

- Less stress

🤝 Who Needs to File a Tax Return in Pakistan?

- Salaried Individuals earning above PKR 600,000/year

- Freelancers & Consultants

- Business Owners & Traders

- Property Owners with rental income

- E-commerce sellers

If you fall into any of these categories, the law requires you to file a return.

🚀 How ADL Law Associates Can Help

We make tax filing easy, legal, and fast. Our team provides:

- NTN Registration

- Income Tax Return Filing

- Business Tax Consultancy

- Sales Tax Compliance

- Bookkeeping & Audit Services

All services are offered online and in-office across Lahore and Pakistan.

🎉 File Now & Avoid the Rush

Don’t let the tax deadline sneak up on you. Call ADL Law Associates today and file your income tax return with confidence.

Freelance or IT Startup in Pakistan?

Are you a freelancer or planning to launch an IT startup in Pakistan? Great move! Pakistan’s freelance and tech sectors are booming, and the government offers incredible support through tax incentives, export facilitation, and digital growth policies. But before you dive in, you need to understand the legal registration process and tax obligations that come with it.

🚀 Why Registering Your Freelance or IT Startup Matters

Many freelancers and tech entrepreneurs start informally, but registering your business legally offers huge advantages:

- ✅ Access to banking and payment platforms (Payoneer, Wise, etc.)

- ✅ Build trust with clients (local & international)

- ✅ Eligible for government incentives & export rebates

- ✅ Easier to scale & hire employees

- ✅ Peace of mind with legal compliance

When your business is registered, clients feel more confident working with you. It shows you’re serious, reliable, and ready to take your work to the next level.

📄 Business Registration Options in Pakistan

Freelancers and IT businesses can register under:

1. Sole Proprietorship (For Freelancers)

- Easy to set up

- NTN registration required with FBR

- Ideal for solo professionals

- Can open business bank accounts and receive international payments

2. Partnership/AOP (Association of Persons)

- For two or more founders

- Shared responsibilities & profit

- Requires separate NTN and firm registration

- Suitable for small agencies or tech teams

3. Private Limited Company (Pvt Ltd)

- Best for IT startups seeking funding or scaling

- Registered with SECP

- Requires corporate compliance (filings, audits, etc.)

- Builds strong credibility with investors and clients

📆 Taxation for Freelancers & IT Companies in Pakistan

Understanding tax is just as important as registration:

✅ Freelancers (Sole Proprietors)

- Income is taxed as personal income

- Must file annual Income Tax Return to become a filer

- If earning foreign remittance via IT services, you can qualify for 0.25% tax under PSEB registration

- Being a filer helps reduce withholding taxes on banking and property transactions

✅ IT Startups (Companies)

- Corporate tax rate: 29% (subject to exemptions and rebates)

- Export income from software, IT services, and digital goods is 0.25% tax-exempt under specific conditions

- You may need to register for Sales Tax depending on your turnover and service type

🌟 PSEB Registration: A Must for Freelancers & Startups

Pakistan Software Export Board (PSEB) registration provides:

- Income tax exemption on IT exports

- Access to training & funding programs

- Inclusion in government directories for foreign clients

- Enhanced credibility in the global tech market

It’s a golden opportunity, especially for freelancers exporting services. And the process is easier than you think when handled professionally.

💼 How ADL Law Associates Helps You Get Started

We specialize in:

- ✅ NTN Registration for Freelancers

- ✅ SECP Company Incorporation

- ✅ PSEB & Tax Exemption Registration

- ✅ Income & Sales Tax Return Filing

- ✅ Complete Legal & Tax Consultancy for Startups

Whether you’re a freelance graphic designer, developer, digital marketer, or launching the next big SaaS platform, we’re here to take care of the boring legal stuff so you can focus on growing!

We understand your challenges—dealing with FBR, complex tax terms, and confusing forms. That’s why we’ve designed our services to be simple, fast, and transparent.

🚀 Ready to Take Off?

Don’t stay stuck in the informal economy. Register your business, manage your taxes, and scale confidently with Adk Law Associates by your side.

Let us help you start your journey the right way—professionally, legally, and with peace of mind.